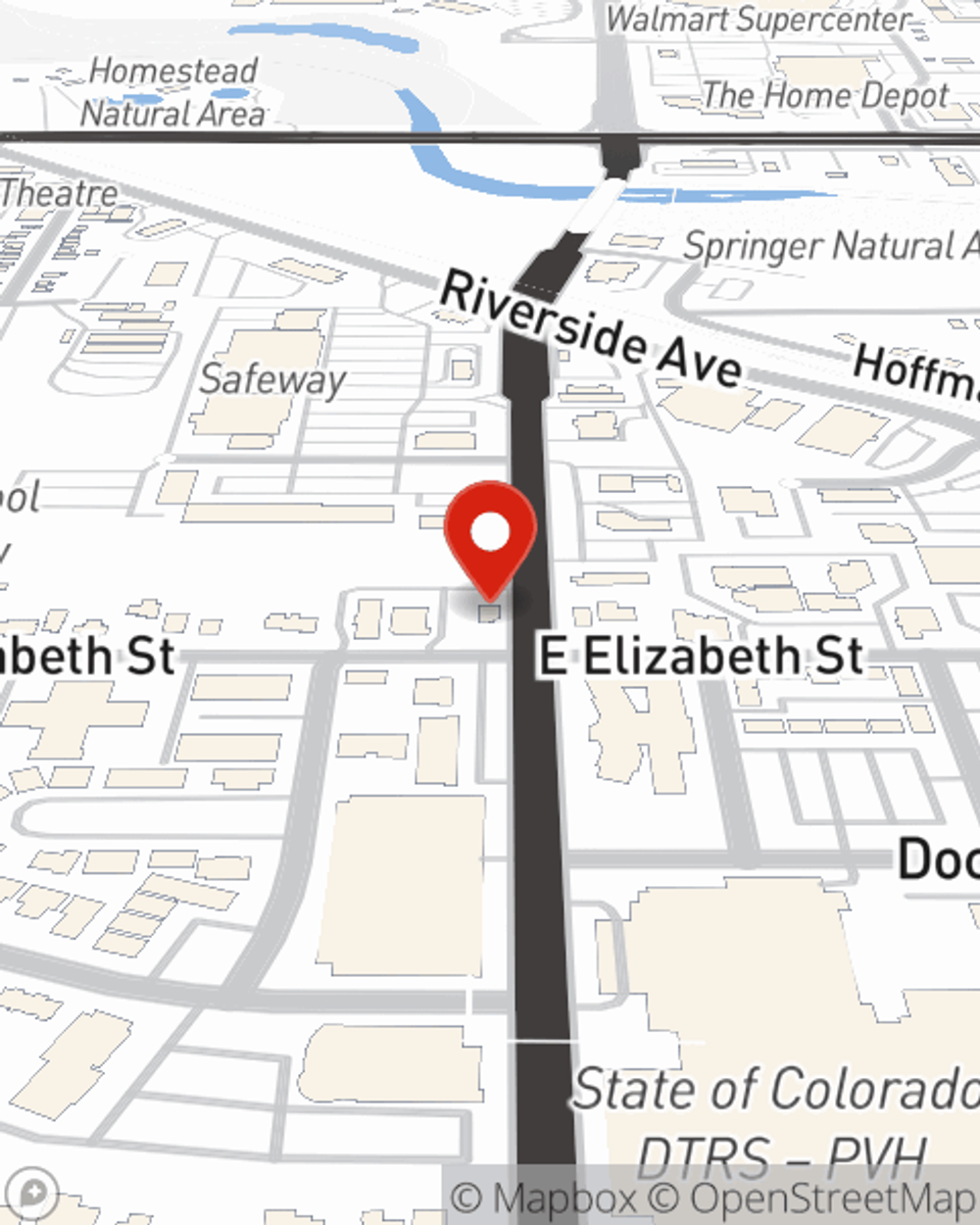

Condo Insurance in and around Fort Collins

Townhome owners of Fort Collins, State Farm has you covered.

Condo insurance that helps you check all the boxes

Your Possessions Need Protection—and So Does Your Condominium.

As with any home, it's a good plan to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Townhome owners of Fort Collins, State Farm has you covered.

Condo insurance that helps you check all the boxes

Protect Your Condo With Insurance From State Farm

Things do happen. Whether damage from hail, vandalism, or other causes, State Farm has terrific options to help you protect your unit and personal property inside against unpredictable circumstances. Agent ERic Moskalski would love to help you set you up with a plan that is personalized to your needs.

Want to learn more about the State Farm insurance options that may be right for you and your condo? Simply reach out to agent ERic Moskalski's team today!

Have More Questions About Condo Unitowners Insurance?

Call ERic at (970) 493-1888 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

ERic Moskalski

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.